Home > Digital contracts: The complete UK business guide

Digital contracts: The complete UK business guide

Your finance director just discovered that three clients were billed incorrectly last month. Why? Because the pricing in your signed documents didn’t match what sales actually negotiated, and now you’re facing awkward conversations (at best).

Poor contract management costs organisations around 9% of their annual revenue. For a mid-sized company turning over £20 million, that’s nearly £2 million walking out the door because of manual data entry errors, missed renewal dates, and pricing inconsistencies.

Traditionally, contracts had to go through a maze of disconnected systems throughout their lifecycle. Today, with digital contracts, you can create a connected contract workflow from quote, all the way to payment and archiving.In this guide, you’ll learn what technology powers modern contract management solutions, and why UK businesses are finally abandoning filing cabinets and handwritten signatures.

Understanding electronic contracts

Note the subtle difference: electronic contracts are any agreements executed electronically, including scanned PDFs. Digital contracts are more sophisticated systems in which the contract exists online as structured data rather than just an image of a document.

A digital contract is an agreement created, negotiated, signed, and managed entirely through electronic means. Under the UK’s Electronic Communications Act 2000, these contracts have the same legal status as their paper equivalents, as long as they meet certain requirements: offer, acceptance, consideration, intention to create legal relations, and certainty of terms.

One thing to note if you’re doing business globally: while the UK follows the Electronic Communications Act 2000 and eIDAS UK regime, the United States operates under the Uniform Electronic Transactions Act and the ESIGN Act (Electronic Signatures in Global and National Commerce Act). These laws similarly provide legal enforceability for digital contracts, though the specific requirements vary.

The legal enforceability of e-contracts

Yes, digital contracts are legally binding in the UK, but there are nuances you should be aware of.

The eIDAS UK regime (which replaced the EU eIDAS regulation post-Brexit) governs electronic signatures and their legal enforceability. This framework establishes three types of electronic signatures: simple, advanced, and qualified. For most business-to-business sales contracts, a simple electronic signature is enough. According to the UK government’s guidance, “Electronic signatures have been legally valid in the UK since 2000.”

A digital signature specifically refers to an advanced type of electronic signature that uses cryptographic technology to verify the identity of the person signing and ensure the integrity of the signed document. Digital signatures are rarely required for standard commercial contracts, but are required or strongly preferred in certain regulated, high-assurance, or jurisdiction-specific scenarios.

UK GDPR compliance is mandatory when processing personal data in contracts, meaning you need to have lawful bases for processing of personal data, appropriate security measures in place, and the ability to respond to data subject requests. Digital contract platforms that store customer information must demonstrate compliance with these requirements.

Land registry transactions, wills, and certain consumer credit agreements still require specific formalities that digital contracts may not satisfy. For regulated consumer credit, the Consumer Credit Act 1974 imposes signature requirements that demand careful compliance.

The practical reality for disputes: you need evidence. Digital contract platforms should provide audit trails showing who accessed the document, when they signed, and what version they agreed to. Oneflow, for instance, maintains comprehensive logs with timestamps and IP addresses recorded for every action.

The technology behind digital contracts

Modern digital contracts rely on three technology layers: the document format itself, artificial intelligence for content and compliance, and security architecture for authentication.

HTML-based dynamic contracting (the modern standard)

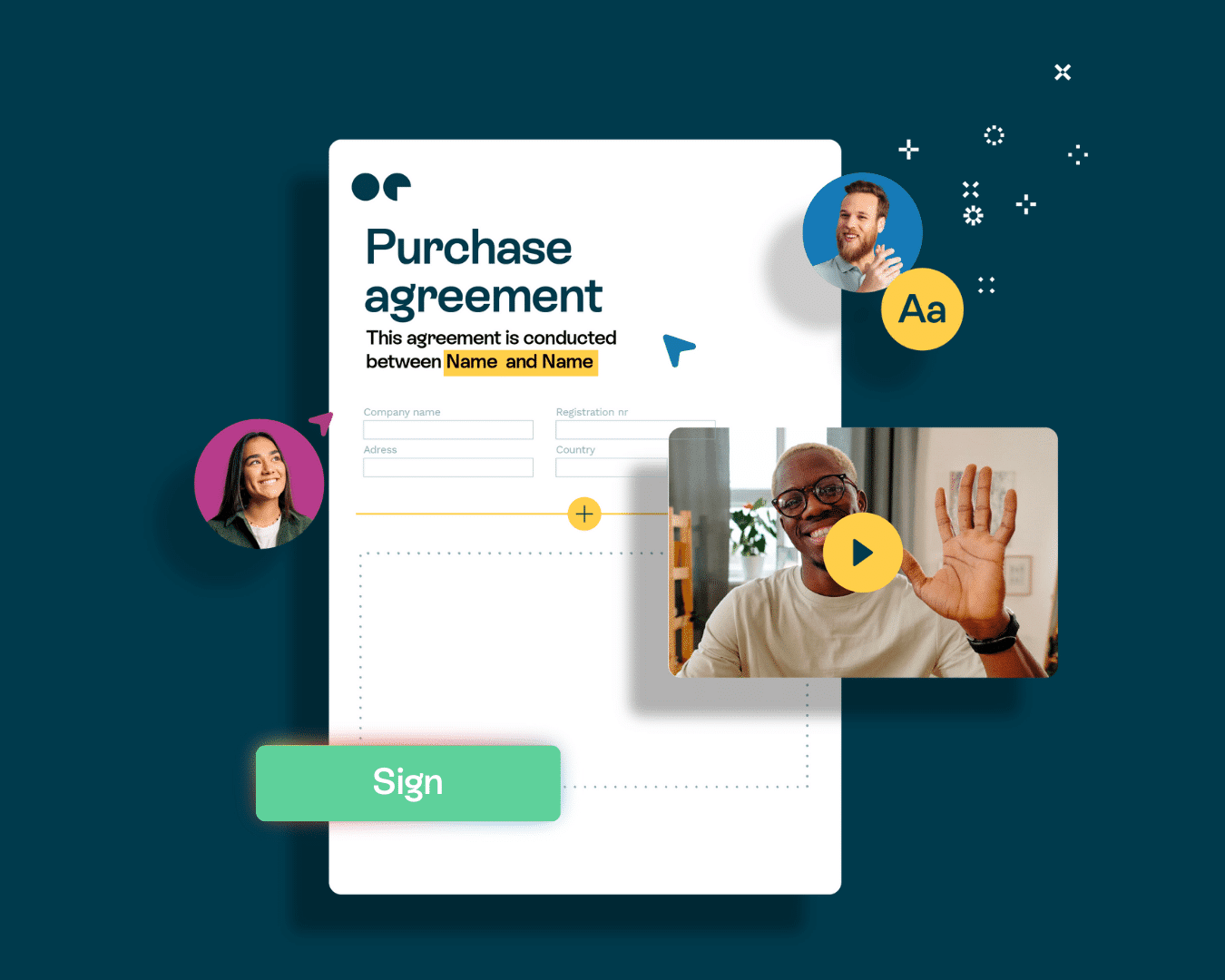

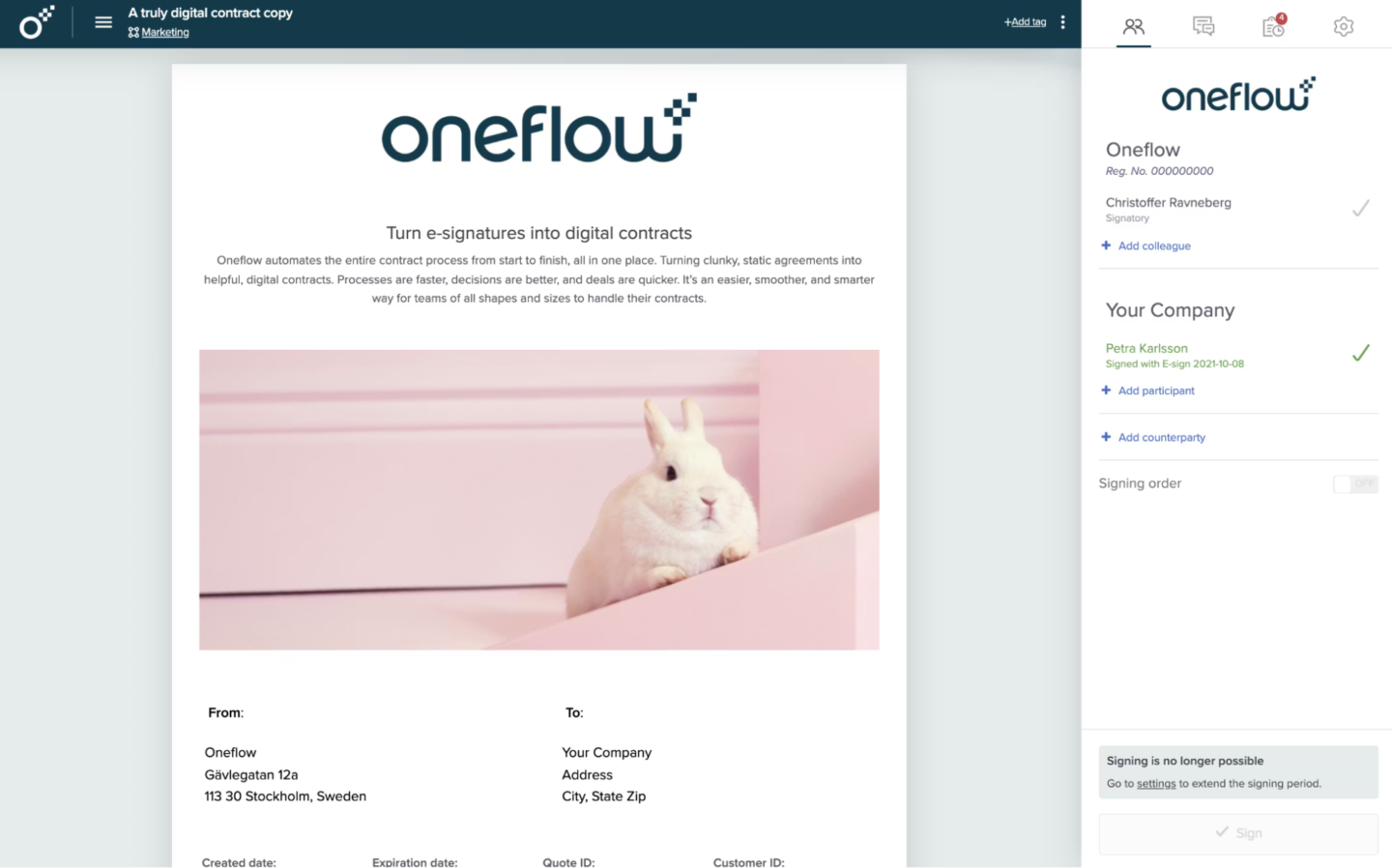

When your contract lives in HTML rather than a static image, both parties can edit the document in real time, similar to Google Docs, but with controls over what can be changed.

In quote-to-cash, this can look something like this: when a sales rep updates pricing in your CRM, that change automatically flows into the contract. When the client signs, their information appears in your ERP and billing systems. One party negotiates, and the other party approves work in the same live document simultaneously. Automated reminders, notifications and smart routing also help move contracts along their lifecycle faster.

Contract lifecycle management platforms like Oneflow keep data synchronised across your tech stack. Traditional paper contracts or PDFs create information silos. HTML-based contracts include structured metadata that your systems can actually use, and you can easily search.

Integrations with CRM, ERP, and billing systems are straightforward because the contract data is already structured. You’re not extracting information from a scanned image. Every field in the contract is a data point your other systems can use.

AI-powered contract intelligence

Generative AI capabilities include contract writing help based on prompts, suggesting alternative clauses based on your internal information, automatically checking for compliance with company policies, and flagging unusual terms that might need legal review.

AI contract management tools can now analyse contracts in natural language. You can ask “What’s our average payment term with French suppliers?” and get an instant answer. The Law Commission‘s guidance on automated agreements acknowledges this technology, noting that contracts can include terms that allow computer programs to make decisions on behalf of the involved parties.

However, while AI helps with repetitive tasks and pattern matching, it doesn’t replace human judgment for complex negotiations. The technology works best for standardised contracts where you’re processing high volumes of similar agreements.

Authentication and security architecture

Multi-factor authentication is now a standard practice for contract platforms. You can’t access sensitive commercial agreements with just a password anymore. Most enterprise-grade platforms provide multi-factor authentication, which is also needed for the UK Cyber Essentials Plus certification.

Encryption protocols protect data both in transit and at rest. End-to-end encryption means that contracts moving between your browser and the platform’s servers can’t be intercepted. Platforms that maintain SOC 2 Type II certification demonstrate ongoing security monitoring.

BankID and qualified digital signatures provide the highest level of identity assurance, which are mostly used when regulatory requirements demand it (for example, in financial services or healthcare). However, for most business contracts, advanced electronic signatures with identity verification through email or SMS codes are enough.

Why UK businesses are abandoning static documents

Post-Brexit administrative complexity made manual contract processes unsustainable. Companies trading with the EU now handle additional customs declarations, certificates of origin, and varying VAT rules. Processing these contractual transactions manually creates bottlenecks, errors and far too many billable hours.

Revenue leakage from pricing errors can’t be ignored either. When sales teams negotiate special terms but finance invoices at standard rates, the gap comes straight off your bottom line. When discounts approved for three months continue for three years because no one set up a proper reminder, that’s revenue walking out the door.

HMRC’s Making Tax Digital requirements demand that businesses maintain digital records and submit VAT returns through compatible software. Traditional paper contracts don’t fit this framework. You need structured data that connects the initial quote to the final invoice.

Adding version control chaos, compliance risks, siloed workflows, invoicing delays, billing errors, and missed upsell or renewal opportunities to the mix, it’s just not worth it. Contract lifecycle management keeps you covered with all that and more.

Essential features of enterprise-grade digital contracts

When choosing a contract automation platform, think about what features matter most for your business processes. Here is a handful of the crucial ones that Oneflow offers.

Live document editing and version control

Edit-after-send capabilities separate modern contract platforms from legacy systems. Platforms like Oneflow allow you to edit contracts online even after sending them, with changes tracked and visible to all parties.

All parties can highlight clauses, suggest alternatives, and discuss terms directly in the document without switching to email or scheduling calls. The contract becomes a collaborative workspace rather than a static file being passed back and forth.

Automatic version histories ensure you can always see what changed and when. Every edit creates a new version with timestamps and user attribution. If a dispute arises about what terms were agreed upon, you have a complete audit trail showing the evolution of the signed document. Locked fields prevent certain terms from being modified, while negotiable ones remain open for discussion.

Intelligent workflow automation and automated reminders

Conditional logic and approval routing ensure the right people review contracts at the right time, with notifications that help move everything along. Contract management automation reduces bottlenecks by ensuring documents don’t sit in someone’s inbox waiting for approval. If a contract hasn’t been signed within a certain number of days, the system sends a polite reminder. Renewal dates trigger notifications before expiry, giving sales time to negotiate extensions.

CRM two-way sync keeps data consistent across systems. When a sales rep creates a contract in Salesforce, customer details, products, and pricing are automatically populated. When the client signs, the contract links back to the CRM opportunity. Our HubSpot integration and Salesforce connector eliminate manual data entry between systems.

Trigger-based actions connect contract events to downstream processes. Contract signed? Automatically create the customer account in your billing system and send onboarding instructions. Contract approaching expiry? Create a renewal opportunity in your CRM and assign it to the account manager. These capabilities automate workflows that previously required manual coordination across departments.

Data-driven contract analytics

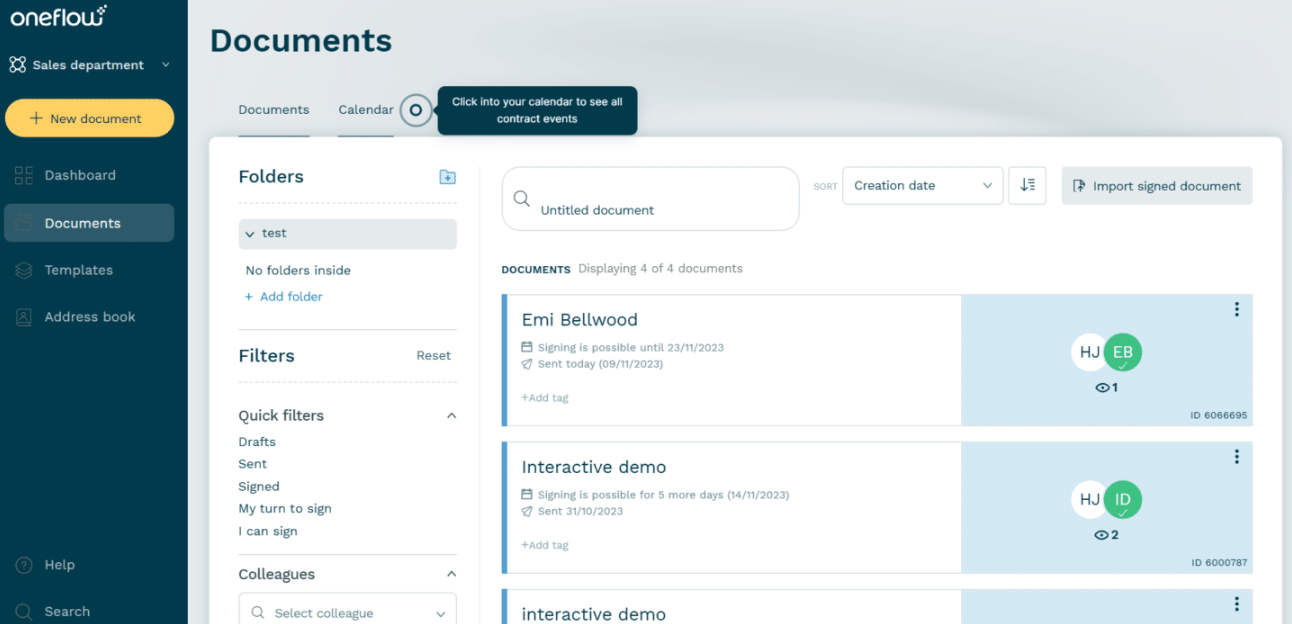

Engagement tracking shows you how prospects interact with your contracts. You can see when they opened the document, how long they spent on each section, and whether they’ve shared it internally. This intelligence helps sales teams know when to follow up or where to improve.

Exportable metadata feeds business intelligence systems. You can analyse average contract values by region, common negotiation patterns, or discount trends. This data informs pricing strategies and highlights areas where sales teams might need additional training or policy updates.

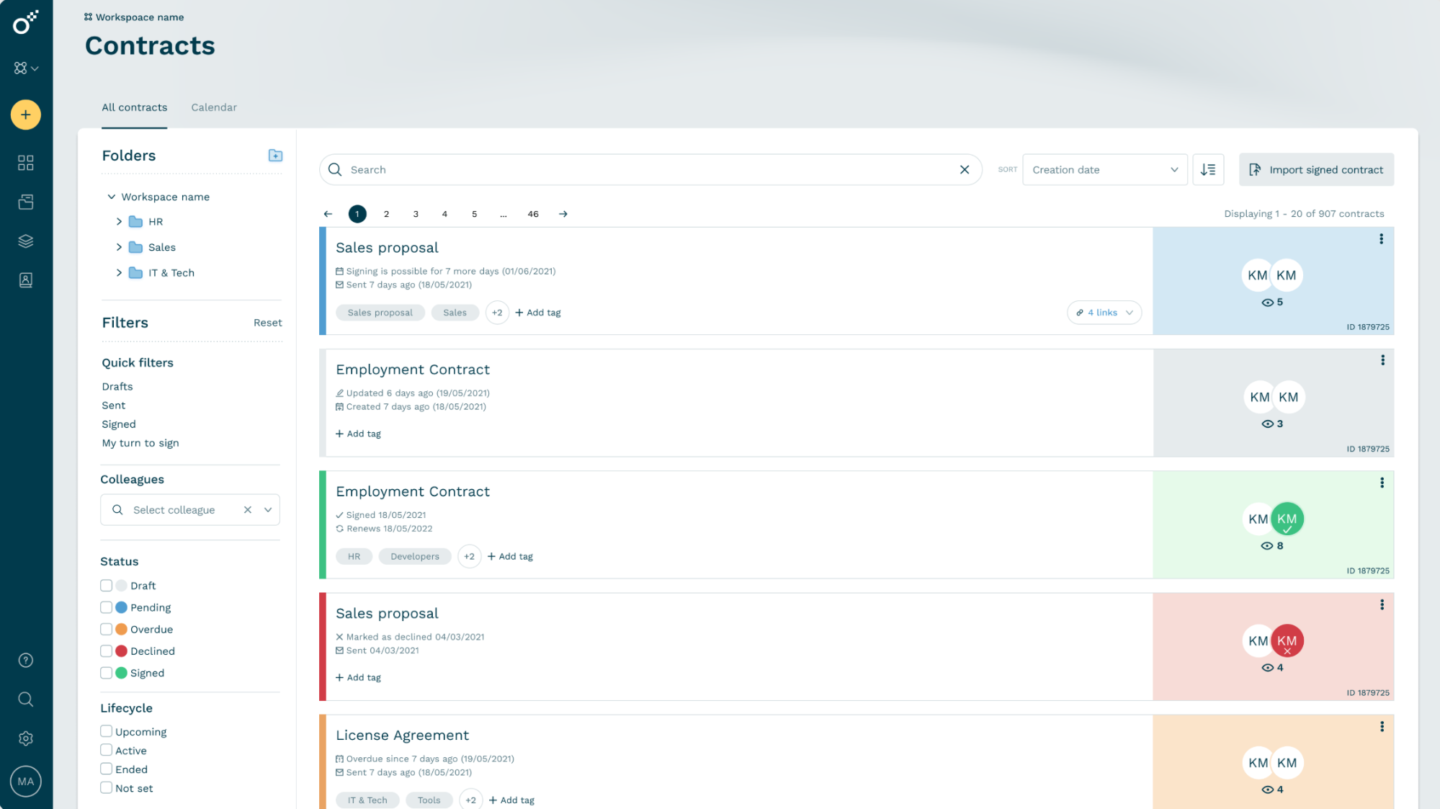

Workspace organisation and search

Department-specific contract repositories ensure teams only see relevant documents: sales can access customer contracts, HR manages employment agreements, and procurement handles supplier contracts. Granular permissions and access controls maintain confidentiality while enabling collaboration.

Global search across all contract content allows you to find any agreement instantly by searching customer names, contract terms, or specific clauses. Additionally, the platform supports tagging, interlinking, folders, and custom fields that let you organise contracts according to your business logic. Tag contracts by product line, region, or risk level. Create custom fields for contract owner, renewal probability, or annual contract value. Link amendments to the original agreements and track the complete contractual history for each customer in a single system.

Digital contracts are no longer optional

The combination of post-Brexit complexity, regulatory pressure from Making Tax Digital, and the simple economics of eliminating manual tasks makes digital transformation the logical step forward.

The question is which platform fits your needs. Static PDFs with e-signatures solve one problem (eliminating paper) but create others (data silos and manual data entry). True digital contract management platforms like Oneflow connect your entire quote-to-cash process, reduce costs through automation, and provide the visibility modern businesses require.

Try Oneflow to see how dynamic contracts with CRM integration and AI-powered features can reduce your contract cycle times and eliminate revenue leakage.

FAQs

Are digital contracts legally binding in the UK?

Yes. Under the Electronic Communications Act 2000 and the eIDAS UK regime, digital contracts have the same legal status as paper contracts, provided they meet the essential elements of contract law: offer, acceptance, consideration, and intention to create legal relations. The validity of electronic signatures is well established in UK law. Exceptions exist for specific transaction types, including land registry, wills, and certain regulated consumer credit agreements.

Are PDF contracts with e-signatures considered “digital contracts”?

Technically, yes, but they lack the capabilities of modern digital contract platforms. A PDF with an electronic signature proves the agreement was executed, but you can’t extract data easily, edit the document collaboratively, or integrate it with your business systems. Modern HTML-based digital contracts offer real-time editing, automatic data synchronisation with your CRM, and structured metadata that connects to your entire technology stack.

Can digital contracts be edited after sending?

This depends on the platform. Traditional PDF-based systems require creating a new version and resending. Modern platforms like Oneflow allow edit-after-send capabilities where authorised parties can modify the contract with all changes tracked and visible. This is particularly useful for remote signing scenarios where terms need final negotiation. Locked fields prevent critical terms from being altered while keeping commercial terms negotiable.

Do digital contracts work on mobile devices?

Yes. Browser-based digital contract online platforms like Oneflow work on any device with an internet connection, letting executives review and sign contracts on the go. Look for platforms that offer native mobile apps or well-optimised browser experiences. The signing process should be straightforward on smartphones and tablets, with clear visual indicators of where signatures are required.

Jump to section

Book a demo of Oneflow

Book a demo of Oneflow

"*" indicates required fields