We aren’t in a recession yet. However, you may wonder if this happens, how to survive and thrive in a recession? Many financial advisors and those in the industry are predicting that one is likely to come in 2023. Sometimes they’re right, and sometimes they’re wrong. That’s the thing with predicting the future, it’s hard to get it right and very easy to get it wrong. With that in mind, it’s better to be safe than sorry. Especially when it comes to protecting your business and finances.

There’s no such thing as being too prepared. Alright, there may be in some situations, but not when it comes to your professional life. It’s wise to be prepared. Even when things are going great and the sailing is smooth. You could assume there’s no need to think about how things could go wrong when everything seems to be going right. But that’s a fatal mistake. As it’s hard to tell when rough seas are coming and that the environment is going to change drastically.

In that spirit, here are a few points and items to keep in mind when thinking about a potential economic downturn. So, here’s how to survive and thrive in a recession:

Spend wisely

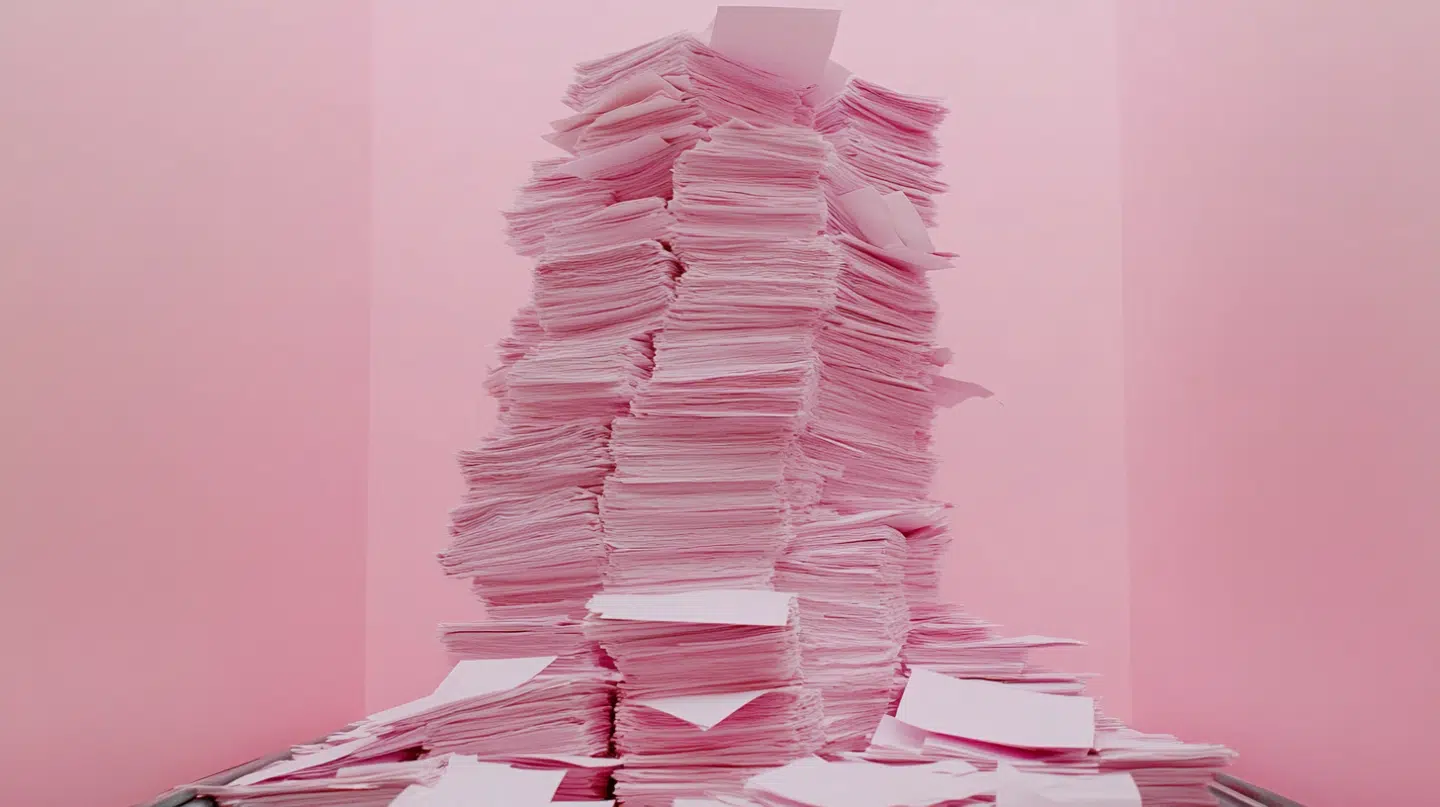

This one isn’t new or groundbreaking. Everyone is aware that when a recession hits, the purse strings get pulled a bit tighter. That means that instead of spending on the newest version of the latest tech tools, you’ll stick with the older versions you currently have. However, that doesn’t mean you’re not going to stop spending. There’s still the costs associated with running a business you have to account for.

Spending is inevitable and necessary. What’s important in order to survive a recession is to spend wisely. And determining what costs are necessary in order for your business to not only continue running but expand. Some of the best business decisions come about due to tough times. Where because of the environment surrounding them, people at companies have to get creative. They’ve got to find ways to achieve larger goals, sometimes with fewer resources at their disposal.

Read also: How to close deals faster with digital contracts?

Survive and thrive in a recession: Wise spending is the key

As an example, hybrid work is now the norm across a large number of businesses and industries. Sure, having a huge office with a great vibe and amenities makes for an attractive workplace for talented employees. Yet, if half of the time a significant amount of employees are working from home, it may be that the company needs less office space, which can be a huge cost-saving measure as real estate is one of the highest fixed costs for a company.

However, if a great company culture and an in-office environment is a business’s core identity, then downsizing in office space doesn’t make sense and will be a detrimental decision. Rather than a wise one. In that case, a company will have to pull another lever that will be a cost-saving measure, such as a hiring freeze or something that may be wise for the bottom line but a bit unpopular with those inside the company.

What to do to survive a recession? Diversify

Sometimes, an entire recession can be caused by the residual effects on one certain product, country, or industry.

For example, let’s do a quick history lesson:

The great recession of 2008/9 was caused by the problem of too many Americans being sold subprime loans which they couldn’t afford. And then those loans being sold as AAA (the highest rated and most secure) bonds to investors. Now, investors didn’t know the bonds they were buying were full of junk. They were under the impression that since they were AAA, they were safe, thanks to them receiving the highest possible rating from the rating agencies.

When those loans started being defaulted on (because they were given to people who didn’t have the means to pay them), it crashed the entire global economy and took down some of the largest, oldest, and most well-established banks on wall street. This is partially because these companies were so financially exposed due to their overreliance on one single asset, bond, or revenue stream. This historical financial malfeasance provides a great lesson for businesses to learn from.

What can we learn from the great recession?

That lesson is to be less reliant on one single asset, product, company, or country for your revenue. A way to combat this is to find companies, industries, or sectors that are vital to the day-to-day operations of an economy. People and businesses still require essential services just to live life and exist. Hospitals, transportation companies, food, and beverage companies, and even some apparel companies still produce and sell their goods when a recession hits. It’s about finding a way to diversify your income and revenue streams.

Being overly reliant on one single product or asset can be a double-edged sword. If you find your niche, where your product satisfies a need and hits the market at the right time. You can see a meteoric rise and hit record profits. However, the same circumstances that caused your company to experience huge success can be the same set of circumstances that cause your company to fold when one or two factors change. To shore things up and lessen the impact of external events on your company, look to the wise words of Wu-Tang Financial, “diversify yo bonds.”

Be resilient

It’s a cliche saying that resiliency can’t be taught but instead that it’s learned. This does ring true. Business and business leaders in today’s world have had to navigate increasingly difficult and volatile situations and economic conditions. There’s no historical precedent for people to look to in order to steer a company through a once-in-a-lifetime global financial crisis. Then, about a decade later, another once-in-a-lifetime global pandemic.

People, and therefore the businesses that they make up, are often the products of their environments. Coming of age or having your professional life during such volatile periods will leave lingering effects on the thought processes, actions, and psyches of those who live and work through them. For example, our grandparents or relatives who went through the great depression would mention how their families would hide money or valuable items in their couches or mattresses because banks didn’t have enough currency to go around. They placed a value on physical currency, while the norm today is to barely use cash as we use cards or our phones to pay. People of that era learned lessons from their environment and experiences, and it informed their actions later in life.

So for companies today and moving forward, learning how to deal with the difficult situations that will occur at an increasing but irregular frequency will be vital to a company’s success and growth. Adapting strategies and being agile in decision-making and execution will become requirements for success in the future. Tough times don’t last, tough people do.

Thrive in a recession: Don’t forecast, scenario plan

Forecasting in business regularly fails to account for major unexpected events. Naturally, it’s hard to predict a once-in-a-century pandemic, the first land war in Europe since WW2, or any other existential event. These events are still going to happen. When they do, they toss a wrench into the laborious and extensive planning that has been done.

To be better prepared for a recession or any economic downturn, rather than forecast, it’s better to scenario plan. This could take the form of coming up with various war game strategy exercises. Where a company’s employees engage in a competition where they act out the actions of reactions of their own company, as well as their competitors, to see likely scenarios and how they react to change or external market forces. It’s a useful exercise that has real-world applications in predicting how a market will evolve, or business will behave during times of change.

Then, when any of the various scenarios do end up going down, or they occur similarly to how you drew it up in your war game session, your company is ready to act accordingly. They have a playbook they can follow in order to successfully navigate through the existential crisis. The plan may fall apart and go wrong. But it’s better than trying to sail through rough seas without a compass. Especially when the cost of being wrong is so high.

Secure the rebound after the recession

One thing to keep in mind is that a recession is always followed by a period of recovery and growth. The recovery period is typically longer than the recession, and historically, recessions have led to prolonged periods of economic growth. As the period after the 2008 great recession was the longest period of sustained economic growth in United States history. It lasted for a whopping 128 months. From June 2009 to February 2020, and was only ended by the covid pandemic. Since then, it’s been off and on with regard to monthly growth.

As mentioned, recovery and growth periods following downturns are often longer than the actual downturn itself. Companies should work on putting themselves in position to take advantage of the growth period that comes after a recession. Of course, survival should be the main focus of a business during tough times. Yet, looking towards the future and enacting policies to give yourself a leg up in the recovery period is a sound move. Those who will win will be ready for the growth period after the downturn.

The recession is not going to last forever. It will last for longer than you’d like, but no two recessions are the same. They vary in cause and in downstream effects. So just as you prepare your company to enter the recession, be prepared to exit it. And do your best to ensure you get some windfalls from the economic growth that comes afterward.

To wrap it all up

There’s no set-in-stone playbook to ensure thriving or even surviving a recession. However, there are some steps and preventative measures you can take to limit the damage, or in the best-case scenario come out stronger on the other side. So give these steps a shot, and you’ll know how to survive and thrive in a recession.

Can Oneflow help you save time and money?

Oneflow provides a range of benefits that can help organizations save time and money across the contract lifecycle.