Tough economic times are never good news. But it doesn’t mean that your business can’t still remain profitable. That’s why we’re here with 10 top tips to save money during a recession.

In this article, we’ll cover:

- Pay off as much debt as you can

- Put together a cashflow forecast

- Create a rainy day fund

- Split the “must-haves” from the “nice-to-haves”

- Invest in automated workflows

- Upsell to existing customers

- Cut down on office expenses

- Get into economies of scale

- Double-down on online events

- Upskill your employees

1. Pay off as much debt as you can

This one might sound like a given, but paying down your debt sooner rather than later gives you more breathing space in your finances, and that can be make-or-break during a recession. A good way to do this could be to start by looking at your upcoming debts. Is there something you’ll need to start paying soon? Is there a large or double payment coming up? If so, prioritize this.

Keep an eye out for early repayment or overpayment fees. But paying down debt in advance can free up more cash further down the line.

Discover your sales assassin alias

And get the tech stack that will support your killer vibe.

2. Put together a cashflow forecast

We can all agree that keeping on top of your books is an essential part of your business. But to keep them well-balanced during tougher times, it’s good to have a cashflow forecast. That way, you can have a clear idea of how your finances should look in the near future, and pick up on any extra outgoings quickly.

Read also: What causes a recession: Top 5 main reasons for a recession

3. Create a rainy day fund

It might mean cutting back on some smaller perks like Friday beers, but creating a rainy day fund can give your business a cushion should things get particularly ropey for a while. An ideal rainy day fund should cover all of your outgoings, including wages, for at least three months. This might sound like a tall order, but it’s a key way to save money during a recession.

4. Split the “must-haves” from the “nice-to-haves”

This tip mostly applies to Marketing and HR, but going through each department’s techstack can be a great moneysaver. It might be that you’re paying for a product that you hardly ever use, or one that can easily be combined with another without affecting your workflows. You should also have a look at all of the tech your teams are using. You might find that quite a few are being used to perform functions that, while useful, aren’t essential to that department’s day-to-day running.

5. Invest in automated workflows

Digital transformations and automations picked up at pace during the pandemic. But now they’re an essential way to save money during a recession. By automating parts of your workflows, particularly when it comes to contracts, you can save time and money. Time can be saved by simply letting automations do laborious manual tasks. Money can be saved as your team can then put that extra time into tasks that generate revenue.

Read also: How technology helps business grow while keeping costs low

6. Upsell to existing customers

The old ‘land and expand’ strategy feels more relevant than ever before today. As companies tighten their belts, it can be a good idea to look at your existing customer base. After all, they already know the value that your solution provides. By selling more licenses, packages, or greater access, you can not only generate revenue, but also further lock in your customer base during these turbulent economic times.

7. Cut down on office expenses

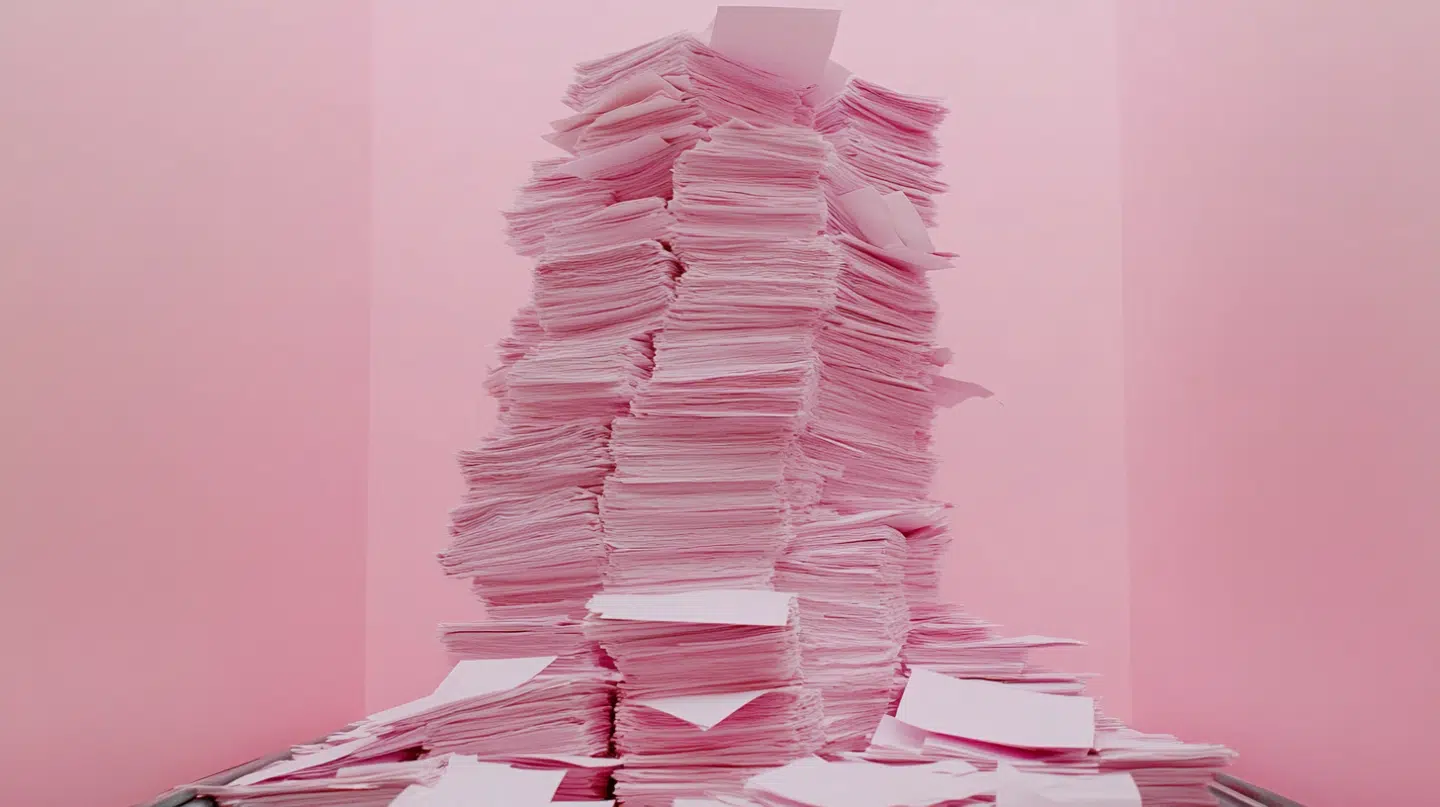

We’ve all seen those signs above the printer that say something along the lines of “Think of the planet. Do you really need to print?” These signs might not do much, but they highlight the very real problem of office waste, something which has become even more acute thanks to the downturn. That’s where your procurement team comes in.

Your procurement team can look around to see if there are cheaper suppliers of the essential things your office needs. You can also encourage your team to turn off lights and appliances they’re not using. With energy prices being what they are, you can also look into switching energy suppliers, if you can lock in a better rate, a great tip to save money during a recession.

8. Get into economies of scale

When tough economic times arrive, it can be good to use economies of scale – i.e. buying in bulk. This doesn’t just apply to physical goods either. If you’re buying software, you can have more leverage in negotiating a good price if you buy more of something.

Doing this can give you more control over your outgoings, as you’ll have bought in bulk at a good price, and won’t have to worry about paying again in the short term.

Read also: Grow your business with contract management software

9. Double-down on online events

We can all agree that events are a great way to put yourself in front of as large an audience as possible. But online events can do that just as effectively as in-person events, if not more so.

Think of it this way: an in-person event only puts your brand in front of those who can attend. Whereas online events can be attended by those who might not have been able to make an in-person event for whatever reason. They can also be open to a global audience, something which in-person events lack.

In addition to this, online events are cheaper to put on. So you can have as much, if not more, exposure to a potential audience for less cash.

10. Upskill your employees

Everyone in the world of B2B is having to get used to doing more with less, be that resources or capital. So, now is as good a time as any to ensure your team’s skills are as diverse and abundant as possible.

It’s worth taking the time to take stock of all of your team’s skills – both hard and soft. If there’s a useful skill that one person has and you’d like to upskill your team in it, you could ask that person to lead a workshop on that skill. It’s a great tip to save money during a recession.

If there’s a useful skill that all of your team could use, then it could be good to send them on a course.