It might seem simple: you receive a document, click a link, sign with eID – and bam, done. But beneath the surface, there are legal requirements, rules, and pitfalls that are worth knowing before you put your signature on a digital document. And no, this isn’t just for lawyers. Anyone working with contracts – whether in sales, HR, procurement, or finance – has everything to gain from understanding the legal framework behind digital signing. Read about the laws and regulations for signing below.

Digital signature ≠ electronic signature. Yes, there’s a difference

Before we go any further, let’s clear up some terminology. Many people use “digital signature” and “electronic signature” interchangeably, but they’re not exactly the same thing.

- Electronic signature is a legal concept. It refers to any form of electronic consent, anything from checking a box to signing with eID.

- Digital signature is a technical method used to secure the document. It involves encryption and ensures the document’s integrity, that it hasn’t been tampered with after signing.

In practice, most people say “digital signing,” and that’s fine. But it’s good to know there is a legal distinction.

What does the law say? We’ve got the EU to thank for a lot

Many countries follow the EU’s eIDAS Regulation or similar local frameworks that define and recognize electronic signatures. The eIDAS Regulation defines three levels of electronic signatures:

- Simple electronic signature – e.g. a typed name in an email or a checked box. Legally valid, but easy to dispute.

- Advanced electronic signature – linked to the person signing, and the document is protected against changes. Example: signing with BankID.

- Qualified electronic signature (QES) – the highest level of security, requires qualified certificates and is legally equivalent to a handwritten signature throughout the EU and EEA.

Depending on the country, common national solutions like BankID, iDIN, or other eID methods qualify as advanced electronic signatures and are sufficient for most contract types.

Read also: What is eIDAS 2.0 and how does it affect digital signatures?

Yes, digital signatures are legally valid – in most countries

In many parts of the world, including the EU, the US, and other major economies, digital or electronic signatures are legally recognized.

Under regulations such as the EU’s eIDAS and the US’s E-SIGN Act, digital signatures are considered legally binding if certain criteria are met, primarily that both parties consent to the agreement.

There are different types of electronic signatures with varying legal strength:

- A simple typed name may be valid but weak in disputes.

- Advanced or qualified signatures (using trusted eIDs or certificates) offer stronger legal standing.

So yes, digital signatures are valid, but the exact rules vary by country. It’s important to choose the right type of signature for the legal system you’re operating in and the type of document you’re signing.

When should you use advanced or qualified signatures?

A simple signature may be sufficient for many types of agreements. But in some situations, it’s highly recommended to use an advanced or qualified signature to:

- Prove who actually signed

- Protect the content from being changed

- Strengthen your position in case of legal disputes

Examples of when secure signing is extra important:

- Employment contracts

- NDAs

- High-value sales agreements

- Shareholder agreements and board documentation

- Powers of attorney

It’s not just about what’s legal, it’s about what’s smart.

Not all documents can be signed digitally – yet

Some legal documents still require handwritten signatures in many countries, such as wills, marriage agreements, and real estate transactions. These are often governed by specific local laws that mandate physical form and witnessing.

What about privacy and GDPR?

Handling and storing signed documents – especially those that include personal data – means you must comply with GDPR. That includes:

- Having a legal basis for collecting signatures and personal data

- Ensuring documents are stored securely and can’t be altered

- Being able to track who has accessed them

Digital signing tools like Oneflow help ensure compliance, but your organization is still responsible for following the rules.

Read also: How to keep personal data flows in check for GDPR compliance with smarter contract management

Who actually signed? Burden of proof and authentication

A common misconception is that digital signing automatically means high security. But without solid authentication, anyone could “sign” in someone else’s name.

That’s why the method of identifying the signer is crucial. With an eID, you’re relatively safe: the person’s identity is verified using official ID. But if you simply send a PDF to an email address and ask them to “click to sign,” you won’t have much to stand on in court if someone denies signing.

What happens if someone denies or regrets signing?

If someone claims they never signed, it comes down to evidence. An advanced or qualified signature gives you a much stronger position.

In legal disputes, detailed digital audit trails — such as timestamps, IP addresses, and eID metadata — often play a crucial role in proving the authenticity of a signature, regardless of jurisdiction.

Pro tip: Make sure your signing platform provides a full audit trail; a log of all actions taken during the signing process.

Where are the documents stored, and who has access?

Digitally signed documents must be stored securely – both legally and practically. That includes:

- Encrypted storage

- Access control

- Ability to review and delete in line with GDPR

And most importantly: the system must be able to prove that the content hasn’t been altered after signing.

So what should you look for in a signing solution?

If you work with contracts – whether you’re in sales, HR, legal, or revops – here’s what you should expect from a modern e-signing platform:

- Advanced electronic signatures (e.g. BankID, Freja eID)

- Automated version control and traceability

- Ability to include multiple parties in a single signing flow

- GDPR-friendly storage and deletion

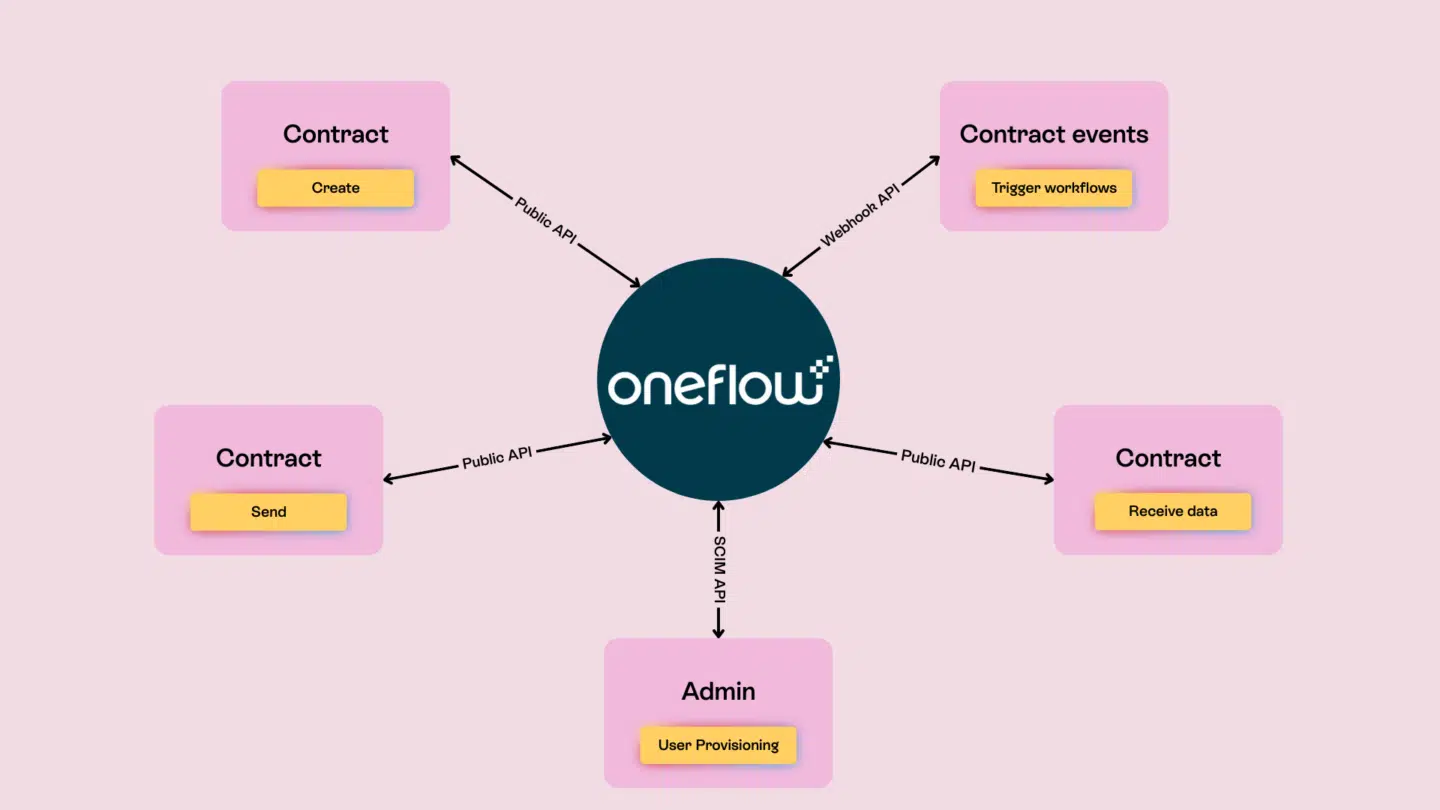

- API integrations with your CRM, HR, or financial systems

- Support for different signature levels, depending on the contract type

It’s not just about getting the signature. It’s about knowing it will hold up afterwards – and having full control the whole way through.

Laws and regulations for signing: How Oneflow makes this easier

At Oneflow, we don’t just build for signing – we build for the entire contract process. With Oneflow, you get advanced electronic signing via BankID in Norway, BankID and Freja eID in Sweden, MitID in Denmark, and several other trusted eIDs across Europe.

Every contract comes with a complete event log, giving you full traceability throughout the lifecycle. Instead of juggling endless email threads and PDF attachments, you can edit contracts live within the platform, with full version control and zero confusion. Once signed, the document is automatically archived in our secure EU/EEA-based storage. Thanks to integrations with popular CRM and HR systems like Salesforce, Hubspot, and Teamtailor, contract workflows become a seamless part of your existing processes.

In short: Oneflow gives you one platform, one version of the truth, and total control from draft to done.

And most importantly: an easier workday for you and your team. Say goodbye to PDFs, outdated Excel files, and “Who signed what when?”. With Oneflow, you get one platform, one version of the truth, and full control – from draft to done.

Disclaimer:

All information on this page comes from publicly available sources and has been collected through research via search engines such as Google, Bing and ChatGPT. Oneflow does not guarantee the accuracy, completeness or timeliness of the information and therefore accepts no responsibility for any errors, omissions or deficiencies. Decisions based on this information are made at your own risk, and we always recommend that you verify the data independently before acting.