Getting a deal from quote to signed invoice shouldn’t be an obstacle course. But for many sales teams—and their RevOps colleagues—that’s exactly what it is: a marathon of manual steps, data silos, and lost momentum. This is where Quote to Cash (Q2C) comes into play.

But what exactly is Quote to Cash, and why is everyone talking about it? Most importantly: how do you ensure the Q2C process actually drives more revenue, instead of just becoming another buzzword in a PowerPoint presentation?

From Quote to Cash: What is Quote to Cash, really?

Quote to Cash describes the entire process from when a salesperson sends a quote to when the money is in the bank. It covers all steps in the commercial journey: from pricing and quote generation, to contract drafting and approval, through to signing and onboarding, and finally invoicing and follow-up.

In other words, it’s the entire commercial engine. An engine that often sputters. According to McKinsey, companies that digitize their Q2C process can increase their conversion rate by up to 20% and reduce time to revenue by up to 50%.

“Hold on, I just need to find the contract…”

It sounds simple in theory, but in practice, sales teams often get stuck in inefficient processes. This might involve outdated templates stored in shared folders, version chaos in Word or PDF files, slow and risky signing processes, and a total lack of visibility for RevOps and leadership.

When contracts are handled manually, it’s not just a time thief—it becomes a real revenue leak. Deals take longer or fall through entirely, and fewer colleagues have a clear understanding of what’s actually been signed.

Fast, smart, and trackable = more deals

A well-oiled Q2C process makes it easy to tailor quotes directly in the CRM and automatically generate contracts with the correct data. The salesperson can send them for e-signature in seconds and receive notifications when the recipient opens, comments on, or signs the contract.

With traceability at every step, you can identify bottlenecks, act at the right time, and shorten the lead time from first contact to closed deal. It’s all about removing friction. For the salesperson, the customer, and the entire organization.

Why RevOps (and the CFO) care

For Revenue Operations, a smooth Q2C process is worth its weight in gold. With the right tools, RevOps gets better forecast accuracy, clearer pipeline data, and a shorter path from order to revenue. This opens the door to analysis, scalability, and clear KPIs.

For the CFO, it means faster cash flow, lower Days Sales Outstanding (DSO), and a more reliable connection between sales and finance. And when onboarding becomes friction-free, churn risk drops and customer satisfaction rises.

Run the numbers: Small wins, big impact

If every contract closes two days faster, and each salesperson makes ten deals a month, that’s twenty working days freed up per month. This means more time for customer contact, more deals closed, and higher quality.

Combined with faster invoicing and fewer contract errors, this could translate to millions in annual gains. Aberdeen Group showed that companies with an automated Q2C process had a 105% higher contribution margin than those with manual workflows.

Checklist: Is your Q2C process a bottleneck?

Do any of the following sound familiar? Are contracts often stored in different folders without traceability? Are there multiple versions of the same template? Can’t see when a contract was opened, read, or signed? Is it impossible to link deals to clear contract data in the CRM? Does it take more than a day to get a contract signed?

If the answer is yes to more than one point—it’s time to act.

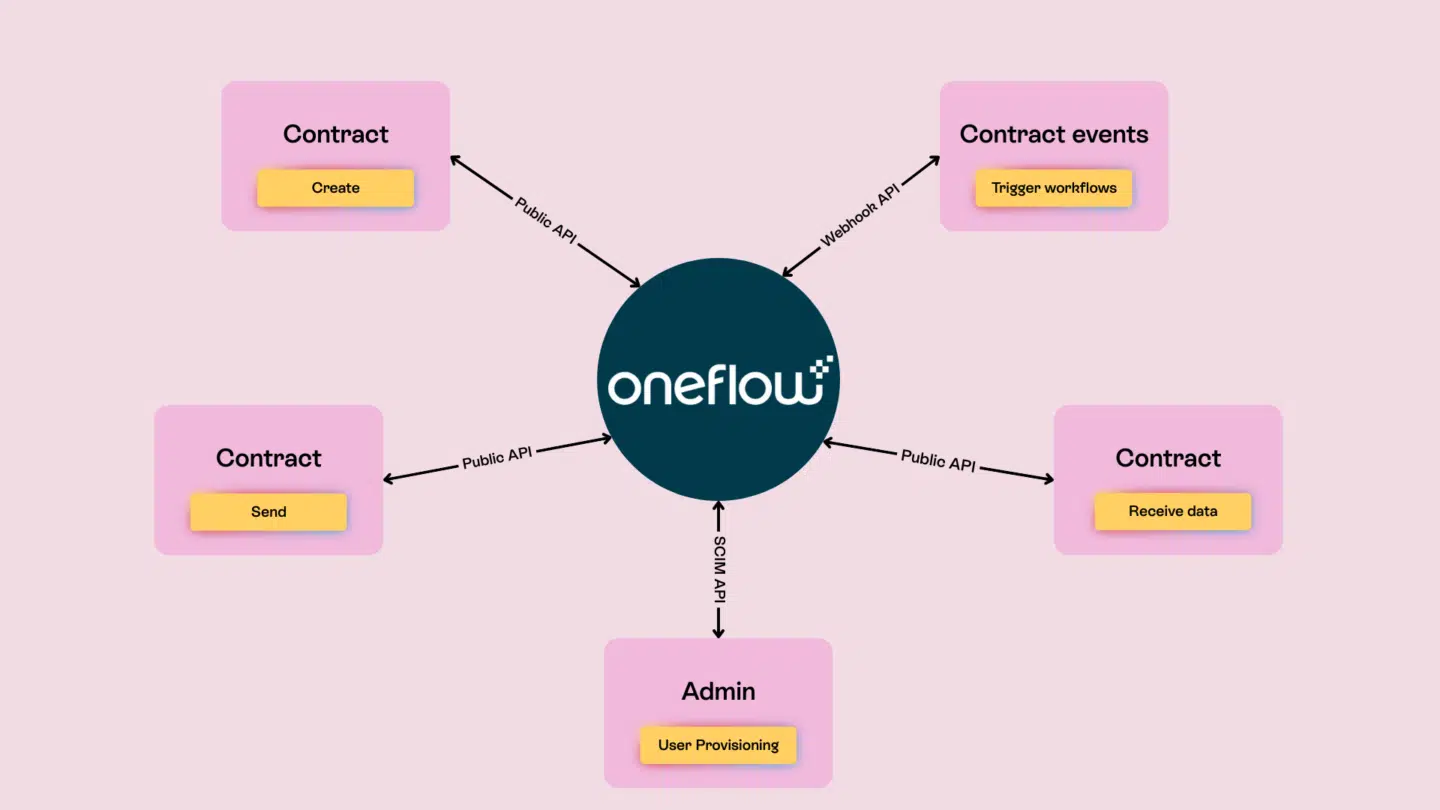

How Oneflow turns Quote to Cash into a flow

Oneflow is built to make the contract journey part of your sales engine—not a standalone system on the side. You can generate and send contracts directly from HubSpot, Salesforce, or Pipedrive, and automate templates with product data from the CRM.

You get notifications as soon as a contract is opened, commented on, or changed, and can sign digitally with full legal validity. At the same time, all contract data stays searchable and up to date in one unified system.

The result? More time to sell. Less headache for RevOps. And a faster path from quote to cash.

Want to see what it looks like in practice? Book a demo here and discover how Oneflow can turn your Q2C process into a revenue machine.