A quote to cash (Q2C) process may appear straightforward at first glance.

However, it comprises several stages, including quote generation, contract negotiations, order management, invoicing, deliveries, and finally receiving payments.

Manually managing this process can be challenging, but when streamlined perfectly, the Q2C process can improve lead conversion and customer satisfaction.

Continue reading to learn why and how you can simplify the process and how automation can play a significant role in streamlining it.

What does Quote-to-Cash mean?

Quote-to-cash refers to the complete business process starting from a customer’s interest in purchasing till the company receives the payment for its services or products.

The process typically starts with sales engaging the customer and, if necessary, configuring the product or service to match their needs.

The sales team then generates a detailed quote that includes pricing and service terms and shares it internally for negotiation and approvals.

Once all teams approve the quote, the company creates a contract to legally bind the agreement with the customer.

After the contract is successfully signed, the company processes the order and generates an invoice.

Following delivery, the customer makes the payment, and the company records it as part of its revenue recognition in financial systems.

How a broken Quote-to-Cash (Q2C) process hurts your bottom line

A broken Q2C can have a severe impact on your business’s revenue-generating processes. Errors or inconsistencies in quotes, delays in internal approvals, or redundancy and mistakes in the contract terms could ultimately lead to lost sales and frustrated customers.

Additionally, poorly integrated systems may increase operational costs, making it more difficult to optimize the Q2C process.

Why Quote-to-Cash can be so frustrating

The quote-to-cash process is generally complex and involves multiple approvals at different stages. Even a small error or delay can upset the entire workflow and result in tasks being repeated.

Too many nanual steps

The process requires sales reps and support agents to manually copy and paste data between different systems, such as from Excel spreadsheets into CRM or from templates into invoicing systems, especially when integrations are lacking.

With so much data related to quotes, deliveries, pricing, and invoicing, there is always a risk of inconsistencies from manual input. This can lead to sending files back and forth between different departments for amendments and approvals.

Different tools don’t connect

One of the most challenging aspects of the Q2C process is proper communication between the various tools used by departments.

Sales teams may be using a CRM software like Zoho or Salesforce, the finance department may be using an ERP (enterprise resource planning) or an accounting tool, and the legal department may be using contract management software.

Inefficiencies in connecting these platforms can create data silos and confusion between teams.

As a result, teams may struggle to find the source of data and misinterpret information. This can lead to manual entry and the sharing of information throughout the process.

Approvals take forever

Another bottleneck in the quote-to-cash process is approval.

Before the data is passed on to the next stage of the process, it typically requires approval from the managers or other relevant authorities.

While some approvals can be quick, many are delayed due to availability or inefficiencies in the review process.

Additionally, if a discrepancy or error is found in the documents, they may get rejected immediately, requiring teams to revise the discrepancies and request approval again.

This endless loop can drag on forever, hold up deals, and overwhelm customers.

Simple mistakes cause big issues

A wrongly priced quote will require a correction. This causes teams to move files back and forth and leads to a loss of credibility with customers. For example, in an HR software subscription deal, quoting for 500 users instead of 1,000 can trigger procurement delays and necessitate additional executive approvals to resolve the discrepancy.

Similarly, missing clauses in the legal documents or contracts may require a revisit, thereby delaying approvals.

In addition, outdated contract templates that reference old annexures or clauses can lead to negotiation of terms, leading to delays or even loss of sales.

Why it’s worth fixing the process

By improving the quote-to-cash process, you can streamline the entire workflow and ensure that all teams – sales, operations, finance, and customer support – are working together to generate revenue.

Deals Close Faster

A streamlined Q2C process faces fewer challenges related to approvals, misinformation, and communication, and it flows smoothly from one stage to another.

As a result, deals move quickly from a quote to a signed contract. This can increase sales and improve the customer experience.

Teams Work Better Together

A rationalized Q2C approach can facilitate better collaboration between teams.

When teams work within a shared platform that integrates all the tools (CRM, ERP, and accounting software) in one place, it simplifies cross-functional communication.

Fewer emails exchanged between teams means no back and forth for approvals, check-ins, or progress.

Customers Have a Better Experience

86% of buyers are willing to pay more for a great customer experience.

So, ensuring that the Q2C process flows smoothly from quote to payments will not only build customers’ trust and confidence in a company but will also enhance the customer experience.

It also reduces the risk of errors and shortens the turnaround time for the customer.

This increases customer satisfaction and the chances of further business or referrals.

Less Risk, Fewer Errors

An automated quote-to-cash process can profoundly minimize the risk of manual errors and mistakes.

Automated steps bring transparency and clarity to the workflow at each stage.

In addition, it also helps ensure contract compliance and minimizes the risk of revenue loss due to errors or delays.

What you should simplify first

Now that you understand the importance of a streamlined quote-to-cash process, let’s look at where to begin improving it for faster, more profitable results.

Quoting and Pricing

Digging through spreadsheets, calculating prices, and generating quotes manually is time-consuming and usually prone to errors.

Begin by integrating tools such as CPQ (Configure, Price, Quote) and templates that can automatically pull in all the product details, pricing, and terms to create accurate quotes in minutes.

This eliminates the need to double-check every action and speeds up the process.

Likewise, B2B sales outsourcing companies that offer tiered enterprise solutions can use CPQ tools or built-in pricing automation to quickly generate quotes based on usage levels or feature requirements.

This helps reduce pricing errors and improves the sales cycle by ensuring proposals are consistent and customized to each client’s needs.

If what you offer are products or services that require a sophisticated evaluation of customer needs, creating an assessment with automated reports can also be a great solution.

Contracts and Negotiation

Contracts and negotiations are critical stages in the quote-to-cash process.

Manually created contracts can be full of outdated formats, redundant clauses, and numerous manual edits, which can lead to extended back-and-forth between your team and the customer.

To solve this problem, many companies are turning to contract management tools.

According to industry data, 81% of companies plan to implement contract automation.

Smart contract tools enable real-time editing and version tracking. Every team member can view the updated version of the contract without any discrepancies.

Teams can also directly share their feedback and comments and work together to improve the contract terms without causing any delays.

Approvals and Signatures

Tracking approvals and signatures is also an important task that requires continuous monitoring.

It can be tedious to manually track where each approval is pending.

Set up automatic rules for approvals, such as categorizing client deals based on their priority or revenue.

Implement rules like requiring a customer deal to move to the final stage within a certain number of days, or deals that generate high revenue are processed with the manager’s sign-off at every stage.

Knowing that certain rules need to be followed helps teams speed up the approval process, resulting in faster closures.

You can also enable real-time alerts to keep team members updated on contract status, and integrate e-signature tools to eliminate the need for printing or scanning. These changes give you full visibility into who has signed, what’s pending, and where bottlenecks exist.

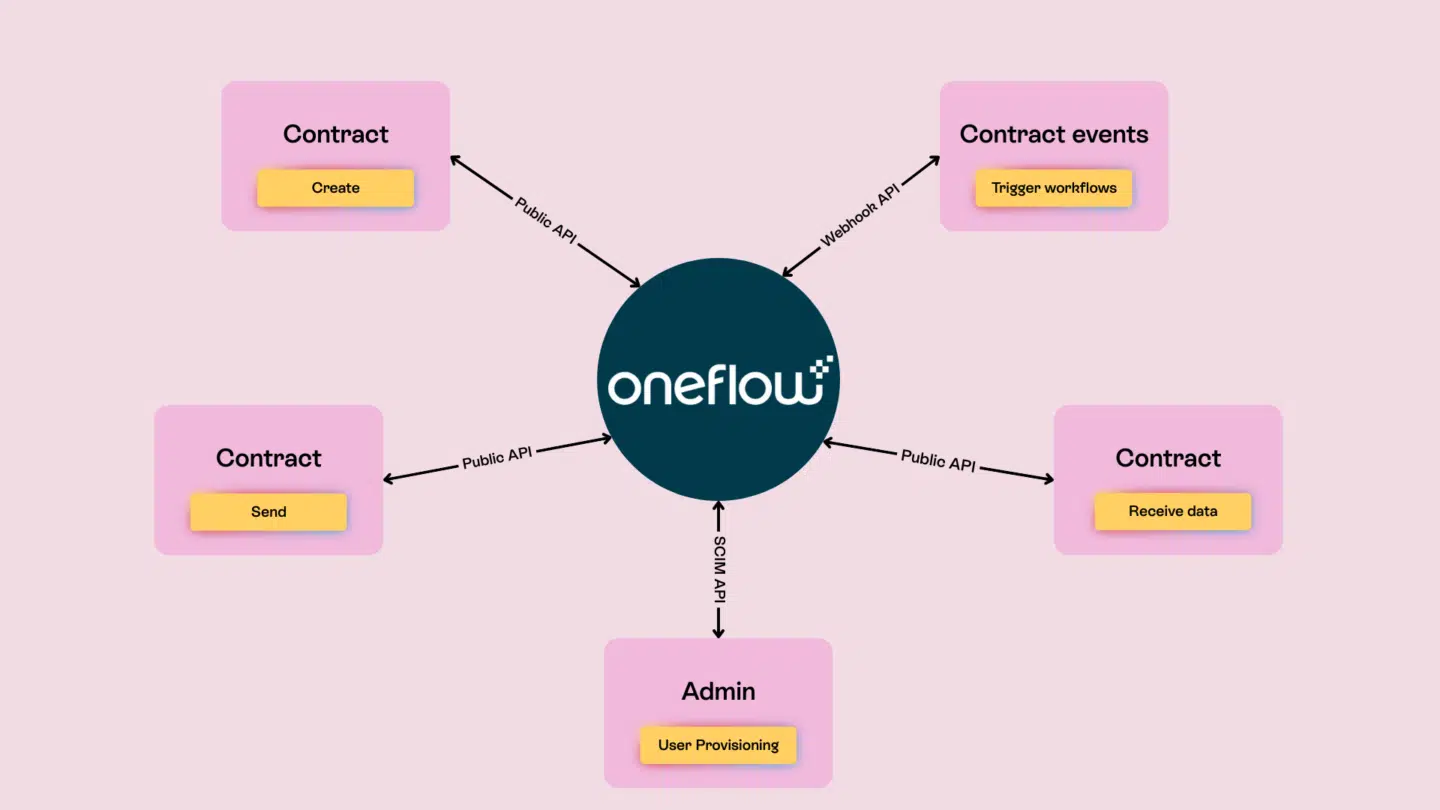

Connecting Your Tools

As already mentioned, the quote-to-cash process involves multiple departments (sales, finance, operations, and customer care) that use different tools, such as CRM, accounting software, contract tools, and billing systems to handle the process.

It is therefore important that these tools are connected via a single source of truth.

When data flows automatically across platforms, you reduce the risk of errors, eliminate repetitive data entry, and ensure that no information is lost between stages.

It also simplifies the tracking of progress from quotation to payment.

How automation helps fix the flow

The quote-to-cash software market is expected to reach USD 2,749.76 million by 2031.

Automation can be a savior when it comes to eliminating the risks and errors caused by manual tasks in the Q2C process.

By automating repetitive tasks, such as performing manual check-ins on the quotation designs, tracking status of approvals, and sending reminders to check and approve the quotes, organizations can remove a lot of back-and-forth communication typically done through emails, phone calls, or personal follow-ups.

Automation helps accelerate the entire Q2C workflow and gives teams real-time visibility into deal progress: which stage a quote is in, what actions are pending, and which contracts are signed and ready for delivery

This way, sales teams can spend more time prospecting for leads instead of wasting time chasing updates from each department.

How to know it’s working

Once you have introduced automation into your quote-to-cash process, it is now time to measure its success.

Tracking key performance indicators is the most effective way to determine whether or not the automated and simplified Q2C process is working as intended.

Start with tracking:

- How long does it take to create and send quotes?

If the numbers indicate a fast turnaround time, then your strategies are working.

- How fast the contracts are getting signed?

A shorter signing cycle indicates that your contract management tool is helping to streamline approvals and negotiations.

- The average time to close a deal

Calculate the time from when the first quote is sent to when the final payment is received from the customer.

A reduction in the average time indicates improvements in the process flow.

- How many deals get delayed or lost due to process issues?

Finally, go through the system and determine the number of deals that were lost or canceled due to delays in approval processes, inconsistencies in contract terms, or other reasons underlying the Q2C process.

If these numbers improve, after you have simplified the process, your changes are working.

Start small, see big results

Simplification is the key to success.

Start by streamlining small day-to-day activities such as manual check-ins on the pending approvals or notifying team members about updates.

Automating and simplifying these smaller activities will boost your confidence to tackle the bigger tasks, such as automating and integrating all tools and workflows on a single platform.

Simplifying and streamlining the quote-to-cash process will not only create a smoother experience for your team members but will also provide a seamless experience for your customers.