Opening a bank account, enrolling in university, accessing government services—all these operations come with repetitive form-filling, uploading sensitive documents and dealing with inconsistent identity checks, especially across borders.

To address these challenges, the European Union is launching a bold initiative: by 2026, every EU citizen, resident and business will have access to a secure, user-controlled European Digital Identity Wallet. It will let you easily prove identity online and offline, safely share verified documents and sign transactions electronically. Of course, you’ll keep complete control over your personal data.

Keep reading to find out what the European Digital Identity is, why it’s needed, its key benefits and how it works in practice. Plus, you’ll learn how you can integrate electronic contracts with digital identity to create secure digital workflows.

What is the European Digital Identity?

The European Digital Identity Wallet (eID Wallet) is a mobile app that lets users store and manage personal identification data (e.g., national ID, driver’s license, European Health Insurance Card, medical prescriptions). With the wallet app, you can also authenticate your identity online and offline, securely share digital documents and create qualified electronic signatures.

The digital identity wallet legal framework for the European Union was adopted in early 2024 through the European Digital Identity Regulation (Regulation (EU) 2024/1183), also known as eIDAS 2.0.

This regulation amends the previous eIDAS Regulation and establishes a secure and trustworthy European Digital Identity Framework. Technical specifications require that each Member State must provide at least one eID Wallet to its citizens and residents by 2026. Following the initial deployment, businesses must accept the wallets by November 2027, enabling wide adoption across public and private services.

Why is the European Digital Identity needed?

The digitalization of public and private sector services across the EU is increasing. This creates a need for a secure, user-friendly way for citizens and businesses to identify themselves online and offline. Banking, e-commerce and government services are shifting from offline to online, leading to a growing need for a trustworthy digital identity solution that could be used across all Member States.

This digital transformation causes several concerns. Many are worried about whether their personal data will be exploited, tracked or profiled by large platforms or governments. The EU Digital Identity Wallet gives users full control over which identity attributes and data they share with third parties. You can be sure you only disclose what’s strictly necessary.

Cybersecurity improvements and fraud prevention are key benefits of the European Digital Identity. The Regulation includes high security standards and certification procedures, helping protect identity data from theft, loss or misuse. This reduces identity fraud for both public administrations and private businesses, increasing trust in online interactions and digital transactions.

Key benefits of the European Digital Identity

The European Digital Identity has multiple benefits for both individuals and organizations, including those listed below.

Easier access to services

Citizens and businesses can use a single, trusted digital identity to interact with public and private services across all EU Member States. This eliminates the need to manage multiple accounts or undergo repeated identity verification.

Enhanced data protection

Users control which identity attributes and documents they share. They maintain full control over personal data, complying with GDPR and data minimization principles.

Strong security standards and fraud prevention

The regulation mandates rigorous security, transparency (open source wallet code) and certification processes. It helps to prevent identity theft, reduce fraud and improve overall trust in digital transactions.

Reduced administrative burden and costs for businesses

The EU digital identity wallet simplifies and automates customer identification and authentication. It lets businesses lower operational costs, avoid dependence on large third-party identity providers and reduce liability related to traditional authentication methods.

Read also: 10 types of documents every business needs

Universal acceptance across EU Member States and platforms

A major benefit of the European Digital Identity is its EU-wide adoption. Users can rely on a consistent, recognized identity system when they access government services, sign up for a mobile plan or submit digital documents for a job.

Business impact

For businesses, the European Digital Identity enables secure and automated customer authentication. It lets you cut down on time-consuming onboarding and verification procedures.

The system reduces friction in digital interactions and eliminates redundant checks, helping lower costs and improve efficiency in business processes.

Many sectors benefit from eID adoption. In finance, it enables secure and compliant Know Your Customer (KYC) processes. In education, it verifies academic credentials and qualifications. For healthcare services, the system means easy and safe sharing of medical records and prescriptions. In public administration, it gives smooth access to government and municipal services (e.g., filing taxes, applying for a passport or accessing social security information).

How the European Digital Identity works

As we briefly mentioned, the European Digital Identity works through digital wallets issued by each EU Member State. Users onboard their wallet by linking their existing national electronic ID schemes. The wallet can then securely hold additional qualified digital credentials and official documents, such as:

- Driving licenses

- Diplomas

- Medical prescriptions

- Travel tickets

- Professional and educational certificates

The wallet enables selective sharing of attributes—users can share only the data strictly necessary for a given transaction. For example, to prove age, you can disclose just that attribute without revealing other personal details.

Citizens can use the wallet for a variety of public and private electronic transactions, such as:

- Opening bank accounts online

- Enrolling in universities

- Applying for jobs

- Booking flight tickets

- Renewing medical prescriptions

- Signing a car rental agreement

- Proving qualifications, identity or other personal attributes to employers or authorities

The wallet uses strong cryptography and meets the highest security and certification standards under eIDAS 2.0 regulations. Users have control to manage, present or delete credentials at any time. Data is stored locally on the device, ensuring no unauthorized tracking or profiling.

Read also: Document storage: Keeping your documents safe and secure

Introducing Oneflow: Enhancing Digital Identity with smarter contract management

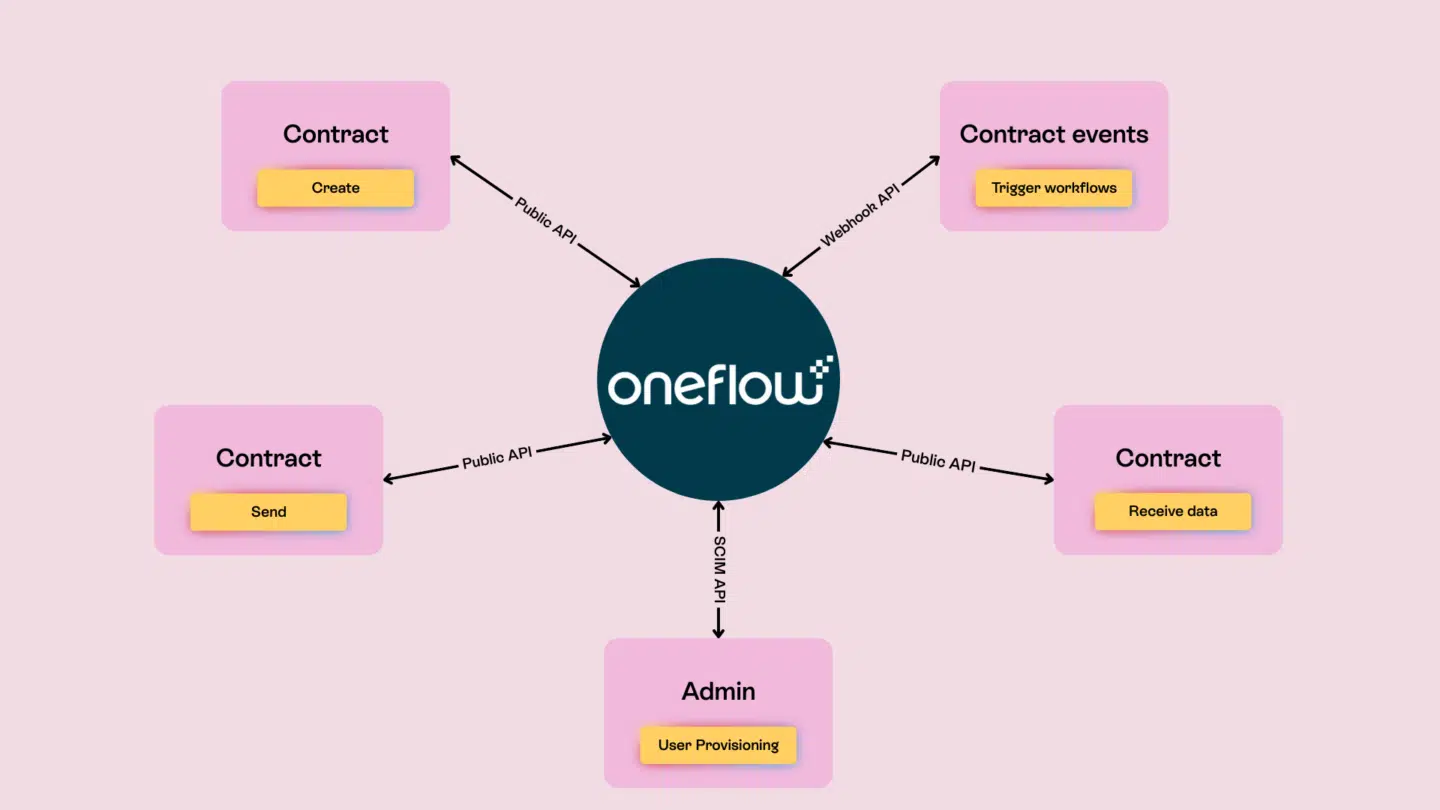

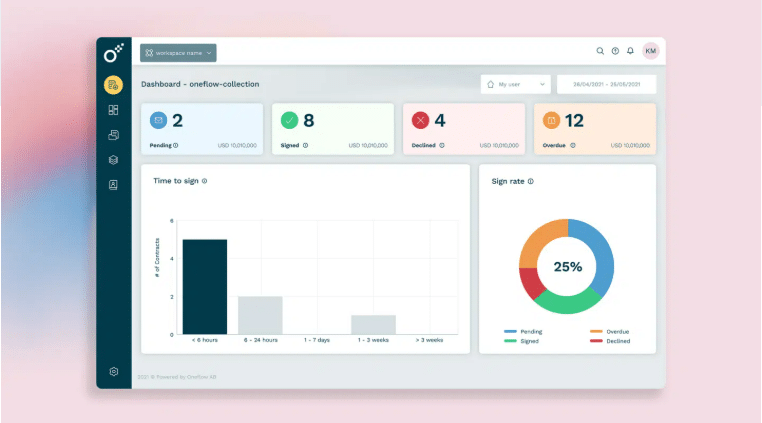

As Europe adapts the European Digital Identity (EUDI), the need for secure and intelligent contract management becomes more essential than ever. Oneflow, a contract management software, is taking the lead in the integration of online contracts with digital identity. It complements the EUDI initiative by automating and securing digital workflows for businesses across sectors.

Oneflow uses interactive, AI-driven digital contracts and automates the entire contract lifecycle, from creation and negotiation to signing and archiving. By combining verified digital identities with dynamic, cloud-based contracts, Oneflow ensures every agreement is secure, legally binding and compliant with EU standards.

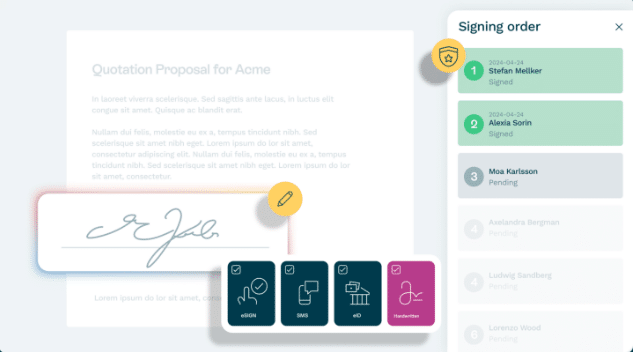

Key Oneflow features that support eID use cases include:

- Secure e-signatures with qualified seals: Ensure legally binding contracts with the highest level of assurance by using EU-compliant electronic signatures backed with qualified trust service providers (QTSPs).

- Real-time collaboration: Draft, review and edit contracts collaboratively in real time, eliminating version confusion and speeding up negotiations across borders.

Read also: How to digitize a signature?

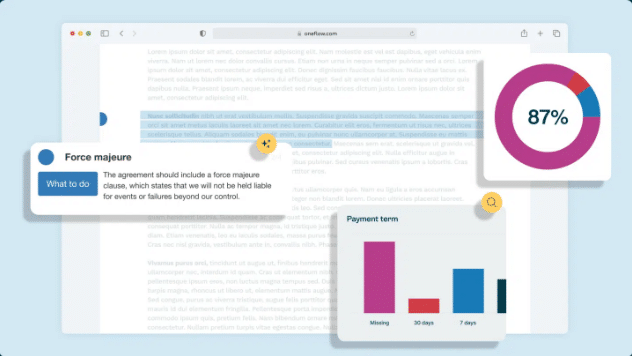

- AI-driven risk and compliance analysis: Automatically detect risky clauses, missing terms or non-compliant language before signing to reduce legal exposure and ensure consistency with internal and regulatory standards.

- CRM and ecosystem integration: Connect with CRM platforms (like Salesforce, HubSpot) and other business systems to create a single source of truth, keeping data accurate and up to date across all workflows.

With Oneflow, businesses can instantly verify signer identities using eID verification and accelerate deal cycles with fewer manual checks. This lets them reduce administrative overhead and compliance risks and build trust with customers through transparent, verifiable processes.

Ready to simplify your contract processes? Try Oneflow and see how it can transform your digital identity workflows into faster, smarter and more secure contract experiences.

Combine safe contracts with European standards

By giving citizens, residents and businesses a trusted digital identity wallet, the EU is laying the groundwork for frictionless access to online services, stronger data protection and reduced administrative burdens.

But identity is only one part of the equation. To fully realize the potential of a trusted digital ecosystem, businesses also need tools that can handle critical processes, like legal contracts, with the same level of security, compliance and efficiency.

That’s where Oneflow comes in. As a leading digital contract platform, Oneflow complements the European Digital Identity by offering AI-assisted, secure and fully compliant digital agreements. From digital signatures to real-time collaboration and integration with your existing systems, Oneflow ensures that your contract workflows are as smart and secure as your identity verification processes.

Try Oneflow and align your contract management with Europe’s new digital trust standards. Simplify and secure your agreements, staying ahead in digital EU.

FAQs

How can a European Digital Identity streamline cross-border transactions and compliance?

European Digital Identity provides a secure, interoperable and legally recognized framework for electronic identification across all EU member states. The key ways it achieves this are:

- Mutual recognition across borders: Digital identities issued by one EU country are valid and acknowledged by all others. It removes the need for multiple authentications or identity verifications when interacting with services in different member states.

- Improved security and trust: The framework uses advanced technologies such as biometric verification, cryptographic keys and qualified electronic signatures. This significantly reduces fraud risk and ensures legal certainty across the EU.

- User control and privacy: When authenticating, users can share only the minimum necessary data. This way, they ensure the protection of personal data and avoid profiling or tracking.

- Interoperability and standardized procedures: The EU has adopted technical standards and implementing regulations to guarantee all member states’ digital ID solutions operate smoothly together.

What are the key benefits of adopting a European digital identity for businesses and consumers?

The key benefits include:

- Improved trust and security: The EUDI Wallet adheres to strict EU standards (eIDAS 2.0), ensuring strong security, privacy and fraud prevention. It reduces identity theft and impersonation risks.

- User control and privacy: Citizens have full control over their identity data and can share only what is necessary. This design prevents profiling, tracking and unauthorized data use.

- Mutual recognition of national electronic IDs: The digital identity gives users secure access to public and private digital services anywhere in the EU. They don’t need to use commercial providers or multiple credentials.

- Simpler business operations: The benefits for businesses include easier customer onboarding, less administrative friction and higher compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. Plus, it lowers costs related to authentication processes.

How does the European Digital Identity protect my privacy?

The European Digital Identity (EUDI) has multiple measures for this:

- Data minimization: You only share essential information required for a transaction, not your entire identity or full data set.

- User control and transparency: The wallet provides a privacy dashboard where you can view every data-sharing transaction and manage your information. You can also request the deletion of your personal data from organisations directly via the wallet interface.

- No tracking or profiling: The system prevents tracking and profiling of your online activity. Neither service providers nor document issuers are informed when you share your digital credentials.

- Local data storage and security: Your personal data and your important digital documents are stored locally on your wallet device under the highest cybersecurity standards.

How to get an EU ID?

To get an EU Digital Identity (EU eiD), wait for your Member State to provide the EU Digital Identity Wallet. All EU countries are required to offer it by 2026. This wallet will be available to every EU citizen, resident and business; you’ll get it from your national issuing authority.

The wallet is voluntary but simple, secure and privacy-friendly, letting users link different aspects of their national digital identities. It works across borders—you can use it anywhere in the EU.